Self -Empolyed

Self -Employed

Self-Employed Mortgage Solutions in Toronto

You Built a Business. Now Build Your Legacy.

You've poured your heart into building something extraordinary. Your entrepreneurial spirit drives innovation, creates jobs, and fuels Toronto's economy. So why should traditional lenders make you feel like your success is a liability?

It's time to work with someone who gets it.

As Toronto's premier mortgage broker for entrepreneurs and self-employed professionals, I specialize in turning your business achievements into homeownership reality. No more apologizing for being your own boss – let's leverage your success story.

The Self-Employed Challenge: Why Traditional Banks Miss the Mark

🏦 The Bank's Narrow View

Traditional lenders live in a world

of T4 slips and predictable paychecks. They see:

Variable income as risk (not opportunity)

Tax write-offs as reduced earnings (not smart business)

Entrepreneurship as uncertainty (not innovation)

The Reality Check

Your accountant helps minimize taxes – that's smart business, not poor income. Your seasonal fluctuations reflect market dynamics, not instability. Your entrepreneurial journey shows resilience, not risk.

The problem isn't your income.

It's finding lenders who understand business ownership.

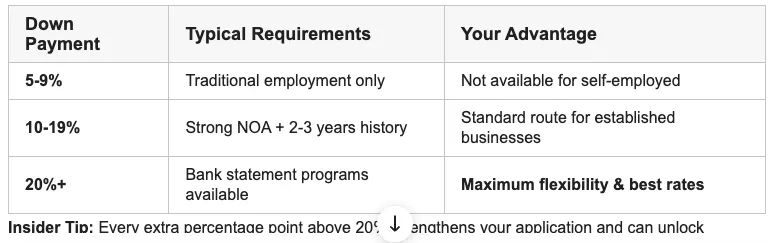

Your Path to Mortgage Approval: The Smart Strategy

Credit Excellence = Negotiating Power

Your credit score isn't just a number – it's your bargaining chip.

Target Score: 650+ (Good) | Sweet Spot: 720+ (Excellent)

Pro Moves:

Separate business and personal credit completely

Use credit regularly, pay balances to zero monthly

Keep utilization under 30% across all accounts

Never miss payments (set up auto-pay for peace of mind)

🚨 Bad Credit? Don't Panic – Pivot.

The Comeback Strategy

Credit Score 500-649? You're not out of the game.

Power Moves:

Increase Down Payment to 25-35% – Shows serious commitment

Demonstrate Cash Flow – 6 months of strong bank statements

Leverage Assets – Investment properties, business equity, stocks

Consider Co-Signers – Business partners, family members

Alternative Lenders – Specialized programs for entrepreneurs

As a contractor in Toronto, I thought my variable income meant I'd never qualify

- Sarah M., Toronto

"Get Pre-Qualified, Find Out How Much You Can Afford".

→ Call Now:

647-241-6652

Thinking of working with me?

Schedule a no obligation call today

Dan Mizrahi

Mortgage Broker

Choice Financial Corp. #13564

Independently owned and operated

Licensed in

Ontario FSRA #13564

Alberta RECA

CF Choice Financial Corp:

BC: BCFSA #MB605782

Services

Contact

Copyright 2026. Your Rate Guy Mortgages. All Rights Reserved.