Home Equity Loan

Home Equity Loan

Home Equity Loan

A home equity loan is a way for you to leverage your investment in your home. Property values typically increase over time. So, as you pay down your mortgage and the value of your home goes up, you build equity. This number is calculated as the value of your home (based on current market assessments) minus the amount you owe or any liens. Imagine this number is the section of your home that you actually “own”.

For example

Your home is valued at $400,000

You have $200,000 left on your mortgage

Your home equity is $200,000

When it comes to borrowing money, you can use this equity to secure a low interest rate or use it as collateral.

Borrowing Against Your Home

Although situations will vary slightly, most lenders will allow you to borrow 80% of the equity you have built up. Using the previous example, your home equity is $200,000 so you would be able to borrow $160,000.

When deciding to borrow against your home, you need to factor in a few extra steps compared to other types of loans. This means the process will take a bit longer as you’ll need a property assessment to discover the current fair market value.

Many people utilize home equity loans for large purchases like

Post-secondary tuition for children

Purchasing a new vehicle

Starting a small business

Home renovation projects (increase the value of your home)

This type of loan can also be used to consolidate high-interest debt

or to pay off outstanding property taxes.

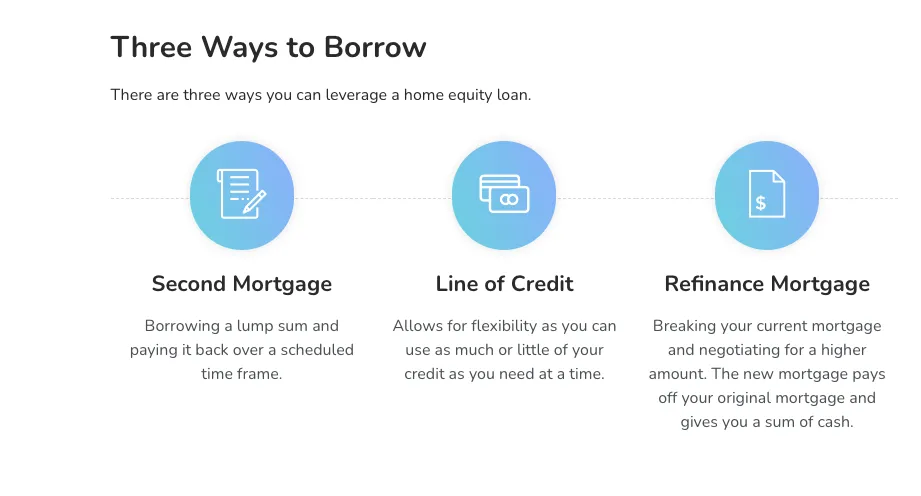

Three Ways to Borrow

There are tree ways you can leverage a Home Equity Loan

Thinking of working with me?

Schedule a no obligation call today

Dan Mizrahi

Mortgage Broker

Choice Financial Corp. #13564

Independently owned and operated

Licensed in

Ontario FSRA #13564

Alberta RECA

CF Choice Financial Corp:

BC: BCFSA #MB605782

Services

Contact

Copyright 2026. Your Rate Guy Mortgages. All Rights Reserved.