Private Mortgage

Private Mortgage

Private Mortgage Solutions

When Traditional Banks Say No, We Say Yes

Your Homeownership Lifeline

Bank denied? Stress test failed? Self-employed struggles?

Private mortgages bypass traditional banking roadblocks. When your credit, income, or timeline doesn't fit the bank's box, private lenders focus on what matters most: your property's value and your ability to pay.

Don't let banking rules delay your Toronto homeownership dreams.

🏠 Private Mortgage Essentials

Same Goal, Different Path

Secured by property (just like bank mortgages)

Private investors/companies as lenders

Faster approvals (days, not months)

Flexible qualification criteria

Terms: 6 months to 3 years typically

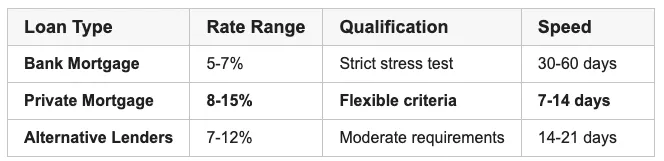

📊 Rate Reality Check

Private mortgages cost more, but they get you in the door NOW vs. waiting years for perfect credit.

🎯 Perfect Private Mortgage Scenarios

✅ Qualification Challenges

Bad Credit (bankruptcy, consumer proposals, missed payments)

Self-Employed (variable income, new business, tax write-offs)

Stress Test Failures (debt-to-income issues)

New to Canada (limited credit history)

Divorce/Separation (complex financial situations)

⚡ Timing/Property Issues

Fast Closings (competitive Toronto market)

Unique Properties (commercial, rural, fixer-uppers)

Bridge Financing (buying before selling)

Investment Properties (rental income focus)

💡 Toronto Market Reality

Home prices rise $2,000-$5,000 monthly. Waiting costs more than higher interest.

✅ Qualification Challenges

Bad Credit (bankruptcy, consumer proposals, missed payments)

Self-Employed (variable income, new business, tax write-offs)

Stress Test Failures (debt-to-income issues)

New to Canada (limited credit history)

Divorce/Separation (complex financial situations)

⚡ Timing/Property Issues

Fast Closings (competitive Toronto market)

Unique Properties (commercial, rural, fixer-uppers)

Bridge Financing (buying before selling)

Investment Properties (rental income focus)

💡 Toronto Market Reality

Home prices rise $2,000-$5,000 monthly. Waiting costs more than higher interest.

"After my divorce, my credit was destroyed and no bank would touch me. Your Rate Guy found a private lender at 11.5% with just 25% down. Two years later, we refinanced to a bank at 6.2%. That private mortgage saved my homeownership dreams."

– Maria S., Teacher, Scarborough

"There is always a solution".

→ Call Now:

647-241-6652

Thinking of working with me?

Schedule a no obligation call today

Dan Mizrahi

Mortgage Broker

Choice Financial Corp. #13564

Independently owned and operated

Licensed in

Ontario FSRA #13564

Alberta RECA

CF Choice Financial Corp:

BC: BCFSA #MB605782

Services

Contact

Copyright 2026. Your Rate Guy Mortgages. All Rights Reserved.